A Sales Allowance Can Be Described as:

Buying a lot of chocolate chip cookies storing them for when you have a hunger attack and then releasing them into your stomach. This offer is not available to existing subscribers.

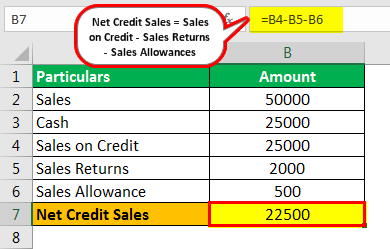

Net Credit Sales Definition Formula How To Calculate Net Credit Sales

A purchase allowance can be described as A reduction in the cost of defective or unacceptable merchandise that a buyer acquired 36.

. You are already subscribed. The amount of total revenues reported by a company on its income statement is usually the net sales figure which means that all forms of sales and. A sales allowance can be described aspng.

An account appearing on a balance sheet of a service company. Tenant Improvement Allowance can be described as a fund that a landlord provides in order to pay for the improvements in the rented property which is occupied by the tenant. Your answer is.

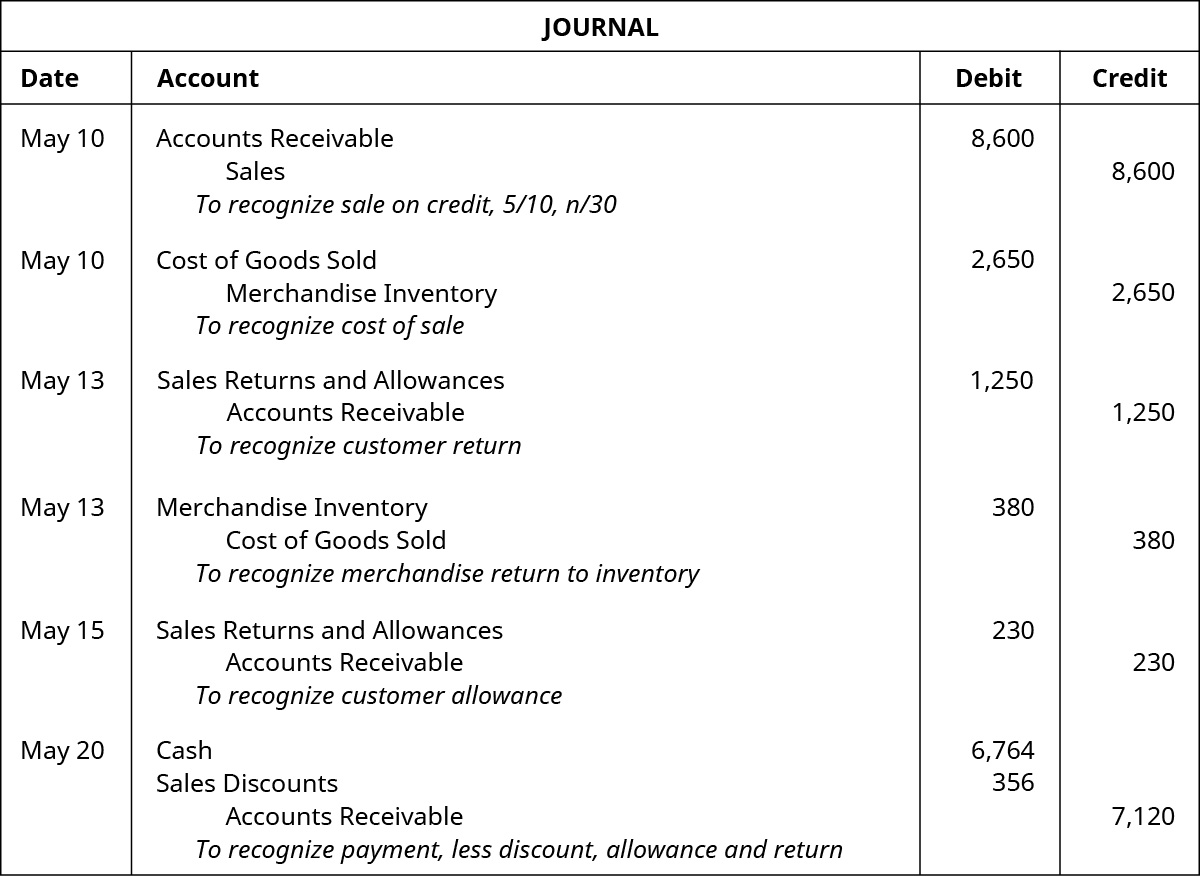

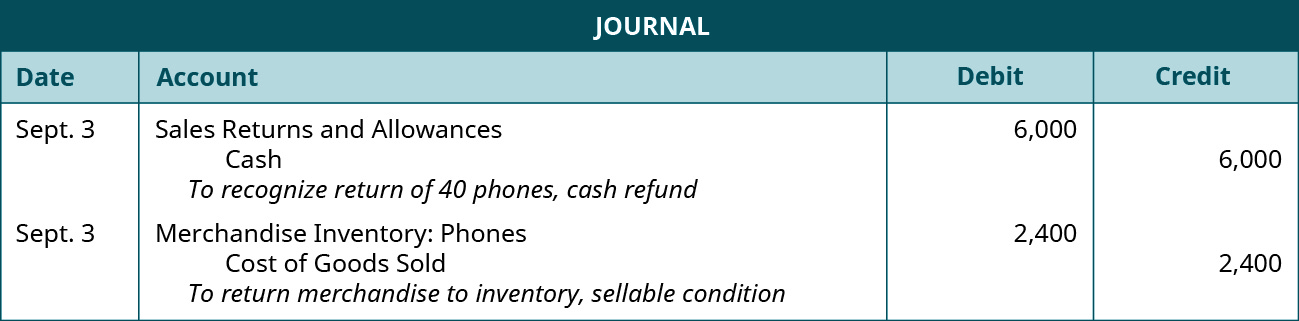

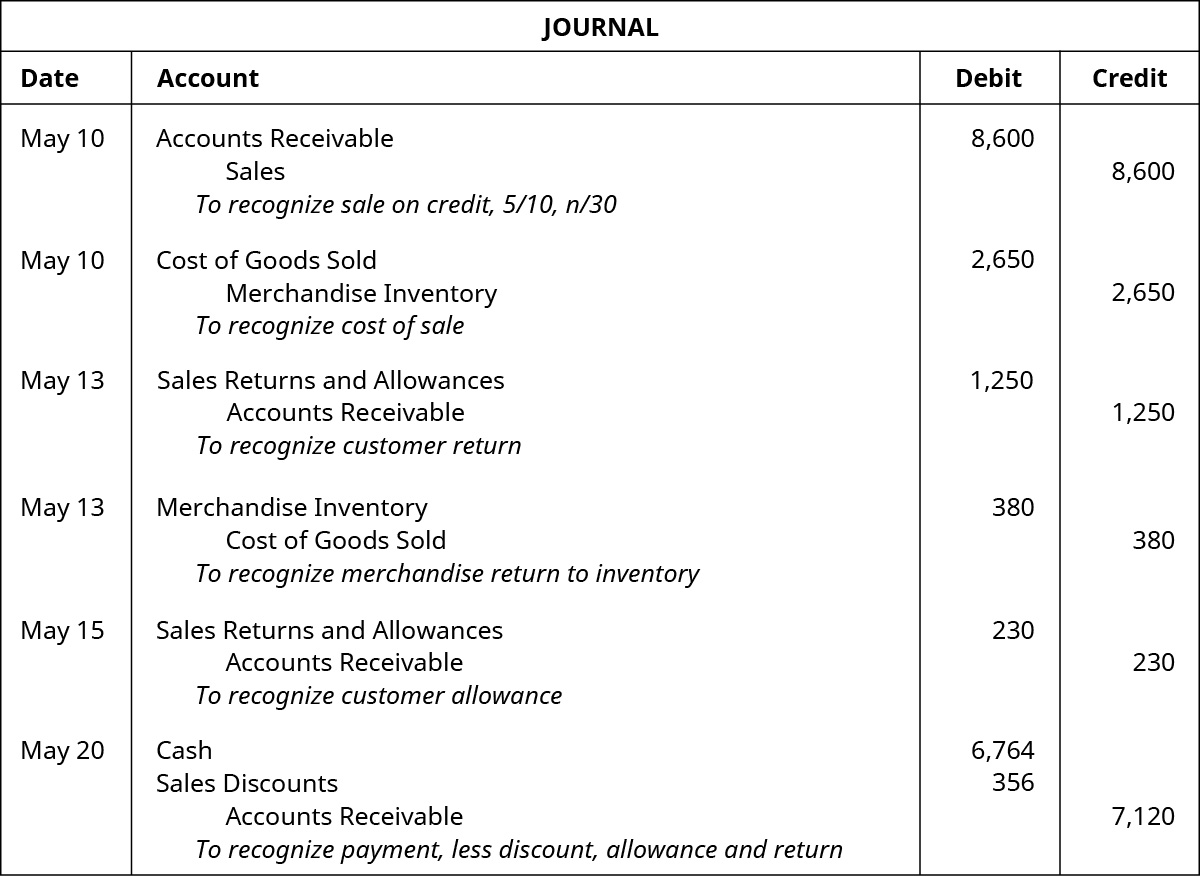

Net sales is total revenue less the cost of sales returns allowances and discounts. Up to 24 cash back check all that applydebit cash 1400credit accounts receivable 1400a sales allowance can be described asa reduction in the selling price of defective or unacceptable merchandise sold to customersa sales return refers to merchandise that customers return to the seller after a saleon jan 5 a customer returned merchandise that had been. Sales Allowances It generally refers to the reduction in price that gets charged to a customer which is usually due to a problem with the sale transaction which does not involve the goods or the service being delivered Example John and co happened to sell goods worth 50000 of which they happened to collect cash worth 25000.

A sales allowance can be described as. The use of the allowance method for estimating bad debts can best be described from ADMS 2500 at Ryerson University. A reduction in the selling price of defective or unacceptable merchandise sold to customers Dogs R US uses the perpetual inventory system to account for its merchandise.

Free Financial Statements Cheat Sheet. Credit Accounts Receivable 150. Overstating or understating allowances and reversing amounts in the future to smooth out net income over time.

1000 of accounts receivable are within the 2 discount period and X-Men expects that. Accounting-and-taxation No related questions found. A sales allowance is a reduction in the price of a good or service that is extended to a buyer due to some sort of issue that arises after the.

Cookie jar reserves can best be described as. A purchase allowance can be described as. Sales Discounts Is a __ account Your answer is correct.

For the recent year the company had gross sales of 510000 and had sales discounts of 4000 and sales returns and allowance of 5000. Accelerating the recording of revenues into. Experience indicates that 70 of the credit sales will be collected in the month following the sale 20.

Assume that X-Men has an unadjusted Accounts Receivable balance of 10000 and Allowance for Sales Discounts balance of 0. A sales allowance is a reduction in the price charged by a seller due to a problem with the sold product or service such as a quality problem a short shipment or an incorrect price. Therefore this is the amount that is paid for improvements that are made to the leased space.

What is sales discounts and allowances. Periodicperpetual inventory system can be described as an inventory system that updates the inventory account only at the end of the period purchaseperiod. An account appearing on a balance sheet of a merchandiser.

Discounts and allowances are reductions to a basic price of goods or services. Debit Sales Returns and Allowances 150. Products that a company owns and intends to sell.

A sales allowance can be described as. Revenue expense contra-asset. Some discounts and allowances are forms of sales promotion.

A sales allowance can be described as. A sales return refers to merchandise that customers return to the seller after a sale. If the customer purchased on credit a sales allowance will involve a debit to Sales Allowances and.

When budget allowances are set without the involvement of the budget owner the budgeting process can be described as. A reduction in the selling price of defective or unacceptable merchandise sold to customers a reduction in the selling price of defective or unacceptable merchandise sold to customers. X-Mart uses the perpetual Inventory system to account for its merchandise.

As a result the company reported net sales of 501000. These allowances mostly include costs that are incurred when the tenant. An allowance granted to a customer who had purchased merchandise with a pricing error or other problem not involving the return of goods.

An account increased with a debit. B a reduction in the cost of defective or unacceptable merchandise that a buyer acquires. A the reduction in the sales price of an item because of the quantity purchased.

Half of all sales are cash sales and the other half are on credit. 1 a debit to Bad Debt Expense and credit to Allowance for Uncollectible Accounts 2 a debit to Allowance for Uncollectible Accounts and a credit to Bad Debts Expense 3 a debit to Bad. This is the primary sales figure reviewed by analysts when they examine the income statement of a business.

C a discount given by the seller of merchandise for early payment. On May 1 it sold 1400 of merchandise on credit with terms of j10n 40.

Sales Returns Allowances Definition Examples Study Com

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment